Digital Gamification in Financial Services

Digital games originally generated revenues for their developers by getting players to buy new features (weapons, new lives, etc) via in-app purchases. More recently, they have generated a sizeable part of their revenues from advertising – whether by the display of adverts covering a narrow strip at the top or bottom, by enticing players to view adverts with the reward of additional game features, or in other creative ways.

Financial services companies have mostly steered clear of such advertising as the nature of the games in the universe didn’t fit well with their offerings.

The development of digital financial games has changed this. These are increasingly being seen as ideal marketing tools for providers of financial advice. This includes banks and financial advisory companies, as well as, in fact particularly, insurers – both life and non-life.

The evolution of gamification in financial services

Gamification in financial services is relatively new but not brand new. Board games which help players to enhance their financial literacy have been around for a few years. An example is Praxis (thePraxis.co) which has achieved traction particularly in South-East Asia.

These board games have enabled financial advisers (most typically life insurance agents) to play the game together with their prospects. The games genuinely serve a valuable purpose of enhancing financial literacy among the contestants. And this educational aspect has helped the providers to also get their games into schools and colleges.

These board games were highly effective at creating a fun environment, particularly for prospects of life insurance agents. However, they required coordinators to ensure the games ran as intended. And were by no means scalable.

With the recent launch of the digital game Cyclic Town by Cyclic Digital (cyclicdigital.com), initially in the U.K. and Singapore, there now exists a truly scalable and dynamic game that delivers financial literacy. Cyclic Town simulates financial life from age 25 (where the player starts as a graduate trainee) to retirement at age 60. Along the way, players experience all sorts of typical life events – some having a beneficial financial impact and some the opposite.

The game tempts players to put in place financial arrangements – by visiting institutions such as banks, insurance companies and even a gold trading house.

The upside of digital financial games

- Achieving brand promotion and leads for sponsors – quickly and on a huge scale

The Cyclic Town game is based around 12 buildings including (amongst others):

- A bank

- A life insurance company

- A P&C insurer

- A securities trading house

- A gold trader

- A real estate company

- A training company

For each country version of the game, Cyclic Digital can accommodate one local sponsor for each of these buildings.

Not surprisingly, digital financial games can reach individuals far quicker and in a far greater scale than the board game equivalents. As an example, a predecessor to Cyclic Town was launched by Cyclic Digital in Vietnam, with a local bank as a sponsor. Within three months and with modest marketing, there were over 30,000 individuals in that one country playing – and repeatedly seeing the bank’s branding within the game.

Effective game promotion has the potential therefore to promote a sponsor’s brand to a significant audience in its country. And has the chance to make that brand synonymous with the financial service it provides – much as ‘hoover’ is used interchangeably with vacuum cleaner.

Cyclic Town is developed in such a way that players are encouraged to reach out to sponsors for guidance in the players real life. Specifically, each country version includes a feature where players can do so. In this way, the game in each country can be a generator of sales leads for the local sponsors.

- Accelerated understanding of financial services products

On the whole, financial services products are more complex than products in most other sectors. This has always proved a challenge for the industry. Getting consumers to understand the products on offer has historically proved a lengthy and expensive exercise.

Digital financial games cut through this like butter. In order to excel in the Cyclic Town game, players do all they can to understand the mechanics of each product. And the games serve well to make understanding of the products far more intuitive.

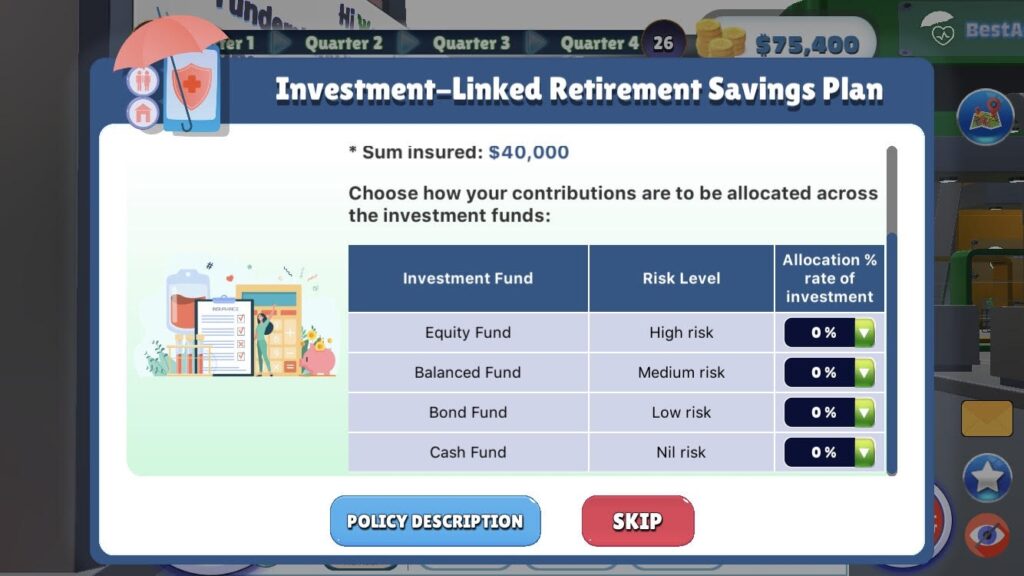

As an example, Cyclic Town requires players who choose to take out an investment-linked life product in the game to make investment allocation decisions. And through the game, they will experience the relationship between risk and return – short term and long term.

Other products players will have the chance to experience include (among various others) health/motor/home insurance, various types of loan products including mortgages, and direct investment in securities.

- Demonstrating the real benefits of each product

Getting players to understand products is obviously valuable. But of greater value is that digital games are highly effective at enabling players to realise the benefits of products and the merits of purchasing them. Digital financial games are very effective at achieving this.

For example, in Cyclic Town, players who choose not to take out health cover or comprehensive car insurance in the game will quite feasibly learn the downside of not doing so when things take a turn for the worse in the game.

- Competitions among closed groups

The developers of Cyclic Town have created a ‘closed competition’ feature which opens up a range of possibilities.

From a purely educational perspective, this feature enables schools to create competitions among sets of students. And from a financial services industry perspective, insurers, banks and securities businesses can do likewise for groups of clients or prospects. No longer are game coordinators needed; or players having to assemble in one location (as with board games). Game organisers (whether teachers, financial advisers, or whoever) can track the progress of players; and can send messages to them through the game. And they, together with the players, will see how all fared at the end of the competition.

For front-line financial advisers, this can be a really good way of building rapport and trust.

- Enhanced financial literacy

The good news is that a financial organisation that sponsors a game and that gets all the above benefits can rightly feel that it is also serving a good service – by enhancing the financial literacy of the players of the game.

In Summary

Sponsoring of a full-fledged digital financial game is not cheap. This should not come as a surprise. In some ways, games like Cyclic Town re-create the product administration system of several financial services sectors.

But the upside, as outlined above, is considerable. Sponsors can achieve enormous brand benefits that typically cost far more to achieve by other, more traditional, means.

Where a game does not have a sponsor in a financial services company’s domain, there is always the opportunity for the company’s financial advisers to run competitions among their clients and prospects at more modest cost.

And the beneficial impact as regards financial literacy means that financial services companies, whether sponsoring these games or utilizing the competition feature, deliver significantly in the CSR space too.

There is little doubt that over the coming years, digital financial games will play an increasing role in the world of financial services.